All Categories

Featured

Table of Contents

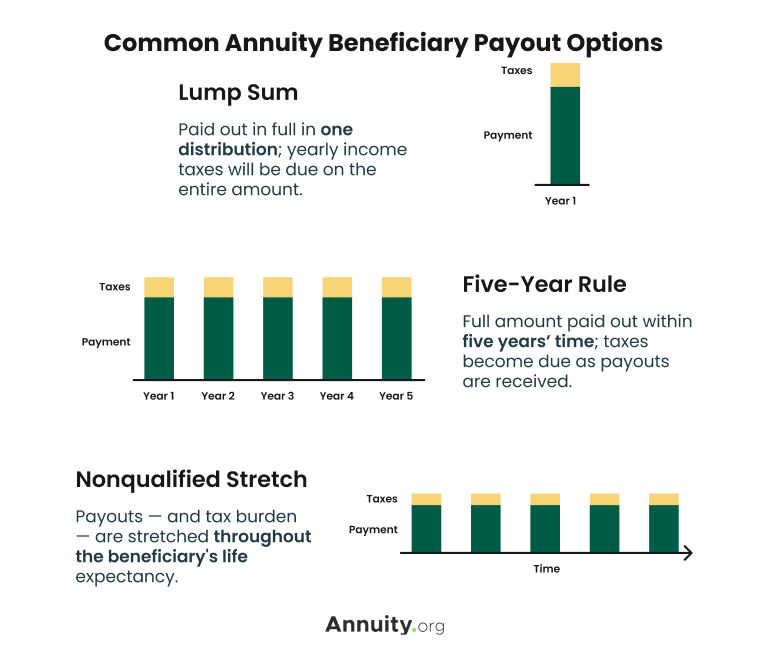

Comprehending the various death advantage choices within your inherited annuity is essential. Meticulously assess the agreement details or consult with a monetary advisor to identify the particular terms and the most effective way to proceed with your inheritance. When you acquire an annuity, you have several options for receiving the money.

In some instances, you could be able to roll the annuity into a special kind of individual retirement account (IRA). You can select to receive the whole remaining balance of the annuity in a single repayment. This alternative uses instant access to the funds yet includes major tax obligation effects.

If the inherited annuity is a certified annuity (that is, it's held within a tax-advantaged retired life account), you could be able to roll it over right into a brand-new retirement account. You do not need to pay tax obligations on the surrendered quantity. Beneficiaries can roll funds right into an inherited IRA, a special account specifically made to hold assets inherited from a retirement.

How is an inherited Variable Annuities taxed

Other sorts of beneficiaries normally should take out all the funds within one decade of the proprietor's fatality. While you can not make additional contributions to the account, an inherited IRA offers a useful benefit: Tax-deferred growth. Revenues within the acquired IRA collect tax-free until you begin taking withdrawals. When you do take withdrawals, you'll report annuity income similarly the plan individual would certainly have reported it, according to the IRS.

This alternative offers a consistent stream of revenue, which can be useful for lasting economic preparation. Typically, you should begin taking circulations no more than one year after the proprietor's death.

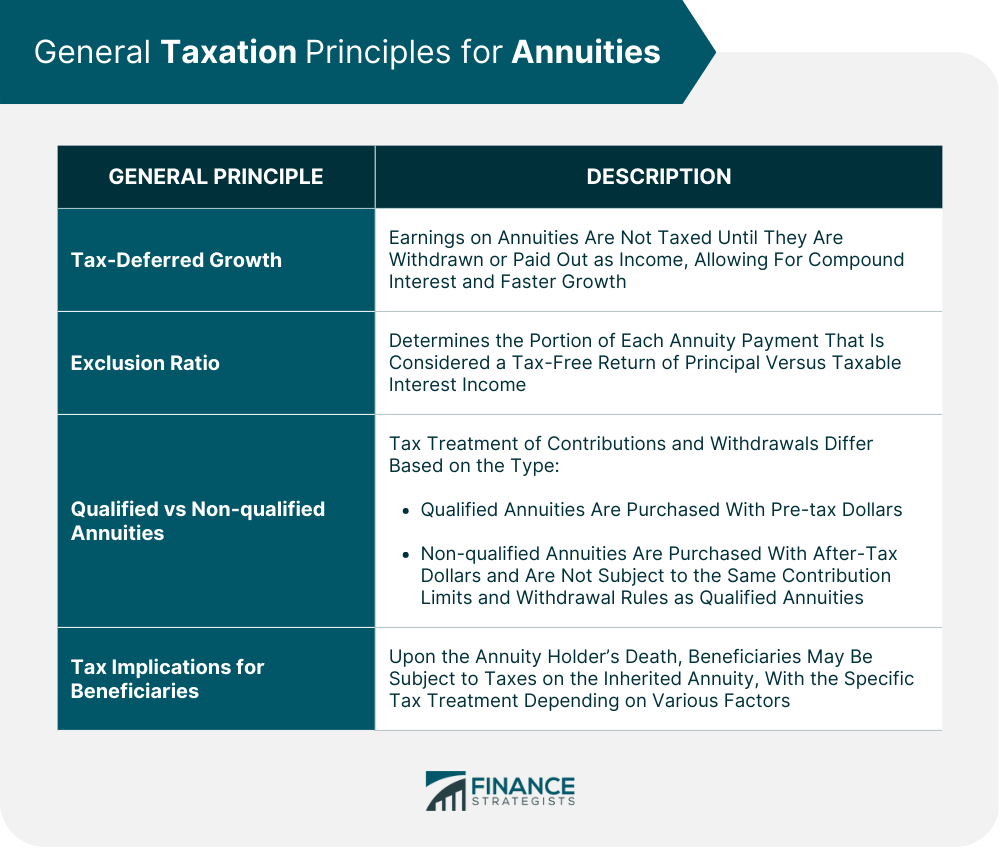

As a beneficiary, you will not be subject to the 10 percent IRS very early withdrawal penalty if you're under age 59. Trying to calculate taxes on an inherited annuity can feel complicated, however the core concept revolves around whether the added funds were formerly taxed.: These annuities are funded with after-tax dollars, so the recipient usually doesn't owe tax obligations on the original payments, but any type of incomes built up within the account that are dispersed go through ordinary revenue tax.

Do beneficiaries pay taxes on inherited Annuity Payouts

There are exemptions for partners that acquire qualified annuities. They can usually roll the funds into their very own IRA and defer tax obligations on future withdrawals. Regardless, at the end of the year the annuity business will submit a Form 1099-R that demonstrates how much, if any type of, of that tax year's circulation is taxable.

These taxes target the deceased's total estate, not just the annuity. Nonetheless, these tax obligations commonly just effect large estates, so for the majority of heirs, the focus needs to be on the earnings tax obligation implications of the annuity. Inheriting an annuity can be a complicated however possibly financially valuable experience. Recognizing the regards to the agreement, your payment options and any type of tax ramifications is vital to making informed decisions.

Inherited Annuity Income Riders taxation rules

Tax Obligation Therapy Upon Fatality The tax obligation treatment of an annuity's death and survivor advantages is can be quite made complex. Upon a contractholder's (or annuitant's) death, the annuity may go through both earnings taxes and estate tax obligations. There are different tax obligation therapies depending on who the beneficiary is, whether the proprietor annuitized the account, the payout approach selected by the recipient, etc.

Estate Taxation The government inheritance tax is a very modern tax obligation (there are several tax obligation brackets, each with a greater rate) with prices as high as 55% for huge estates. Upon death, the IRS will certainly include all building over which the decedent had control at the time of death.

Any kind of tax over of the unified debt schedules and payable nine months after the decedent's fatality. The unified debt will fully sanctuary reasonably moderate estates from this tax obligation. For several customers, estate taxes might not be a crucial issue. For bigger estates, however, inheritance tax can impose a huge burden.

This conversation will focus on the estate tax obligation therapy of annuities. As was the instance during the contractholder's life time, the internal revenue service makes an essential distinction in between annuities held by a decedent that are in the build-up phase and those that have gone into the annuity (or payment) stage. If the annuity is in the buildup stage, i.e., the decedent has actually not yet annuitized the contract; the complete survivor benefit assured by the agreement (consisting of any type of enhanced fatality advantages) will certainly be included in the taxable estate.

Tax on Annuity Withdrawal Options death benefits for beneficiaries

Instance 1: Dorothy had a taken care of annuity contract released by ABC Annuity Firm at the time of her fatality. When she annuitized the contract twelve years ago, she picked a life annuity with 15-year duration particular. The annuity has been paying her $1,200 monthly. Because the contract warranties repayments for a minimum of 15 years, this leaves 3 years of repayments to be made to her child, Ron, her designated recipient (Guaranteed annuities).

That value will be consisted of in Dorothy's estate for tax obligation functions. Upon her fatality, the repayments quit-- there is absolutely nothing to be paid to Ron, so there is absolutely nothing to consist of in her estate.

Two years ago he annuitized the account selecting a life time with cash money reimbursement payment choice, calling his little girl Cindy as recipient. At the time of his death, there was $40,000 principal continuing to be in the agreement. XYZ will certainly pay Cindy the $40,000 and Ed's executor will include that quantity on Ed's estate tax obligation return.

Since Geraldine and Miles were wed, the advantages payable to Geraldine represent property passing to a making it through spouse. Annuity interest rates. The estate will be able to use the endless marriage reduction to avoid taxes of these annuity benefits (the value of the benefits will certainly be detailed on the estate tax type, together with an offsetting marriage deduction)

How are beneficiaries taxed on Annuity Rates

In this instance, Miles' estate would certainly include the worth of the continuing to be annuity payments, yet there would certainly be no marital deduction to balance out that inclusion. The exact same would apply if this were Gerald and Miles, a same-sex couple. Please keep in mind that the annuity's continuing to be value is figured out at the time of fatality.

Annuity contracts can be either "annuitant-driven" or "owner-driven". These terms refer to whose death will certainly trigger settlement of death benefits. if the agreement pays fatality advantages upon the death of the annuitant, it is an annuitant-driven agreement. If the death advantage is payable upon the death of the contractholder, it is an owner-driven contract.

But there are circumstances in which a single person possesses the agreement, and the determining life (the annuitant) is someone else. It would certainly be good to assume that a particular agreement is either owner-driven or annuitant-driven, however it is not that basic. All annuity contracts provided because January 18, 1985 are owner-driven due to the fact that no annuity contracts issued since after that will certainly be approved tax-deferred condition unless it has language that triggers a payment upon the contractholder's death.

Table of Contents

Latest Posts

Highlighting Variable Annuity Vs Fixed Indexed Annuity Key Insights on Immediate Fixed Annuity Vs Variable Annuity Breaking Down the Basics of Pros And Cons Of Fixed Annuity And Variable Annuity Pros

Analyzing Fixed Vs Variable Annuity Pros Cons Everything You Need to Know About Fixed Vs Variable Annuity Pros Cons Defining Pros And Cons Of Fixed Annuity And Variable Annuity Advantages and Disadvan

Exploring the Basics of Retirement Options A Closer Look at Pros And Cons Of Fixed Annuity And Variable Annuity Defining the Right Financial Strategy Features of Fixed Vs Variable Annuity Why Fixed An

More

Latest Posts